Posted On: 04/19/2014 2:11:36 PM

Post# of 36729

Pro: Assuming there are no more than 700m common shares outstanding (697m as of 04/04/2014), an affiliated group holding 350m would give said group voting control of the company. Fortunately, Delaware law forbids issuance of non-voting common shares. Each common share is accorded one vote.

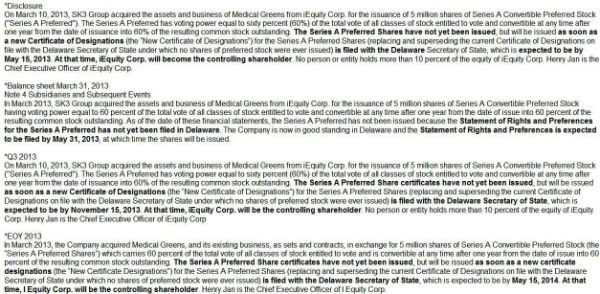

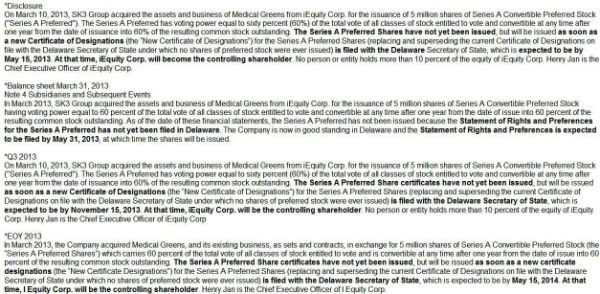

If that scenario obtained, a countermove by iequity would be expected. However, there must be a reason iequity consistently deceives the public from March 2013 on by continually deferring the issuance of the preferred shares -- sequentially moving the expected date of filing of the Certificate of Designations with DE-SOS and, hence, the issuance of preferred that would give iequity actual, not just illusory, 60 percent control. There must a reason for this ongoing deferrence wherein their use of the phrase "expected date of filing" is tortured to the breaking point. See attachment. Is there a serious defect in their scheme that would come to light if they filed the Certificate of Designations? Are they intent on avoiding regulatory scrutiny if 60% control of a publicly traded company is actualized?

Let's call their bluff and organize a shareholder group that will control this company, clean house, and act in the best interest of common shareholders, not just insiders.

Moving the bean at every turn

If that scenario obtained, a countermove by iequity would be expected. However, there must be a reason iequity consistently deceives the public from March 2013 on by continually deferring the issuance of the preferred shares -- sequentially moving the expected date of filing of the Certificate of Designations with DE-SOS and, hence, the issuance of preferred that would give iequity actual, not just illusory, 60 percent control. There must a reason for this ongoing deferrence wherein their use of the phrase "expected date of filing" is tortured to the breaking point. See attachment. Is there a serious defect in their scheme that would come to light if they filed the Certificate of Designations? Are they intent on avoiding regulatory scrutiny if 60% control of a publicly traded company is actualized?

Let's call their bluff and organize a shareholder group that will control this company, clean house, and act in the best interest of common shareholders, not just insiders.

Moving the bean at every turn