Posted On: 04/13/2014 11:45:39 AM

Post# of 2561

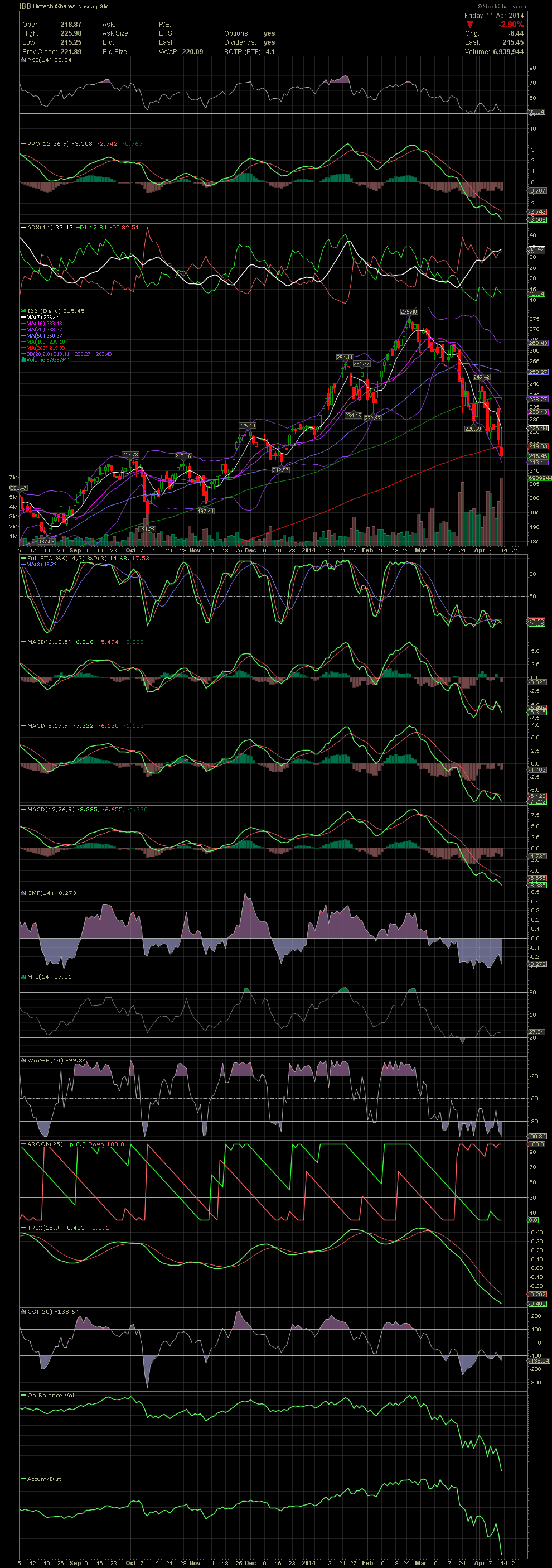

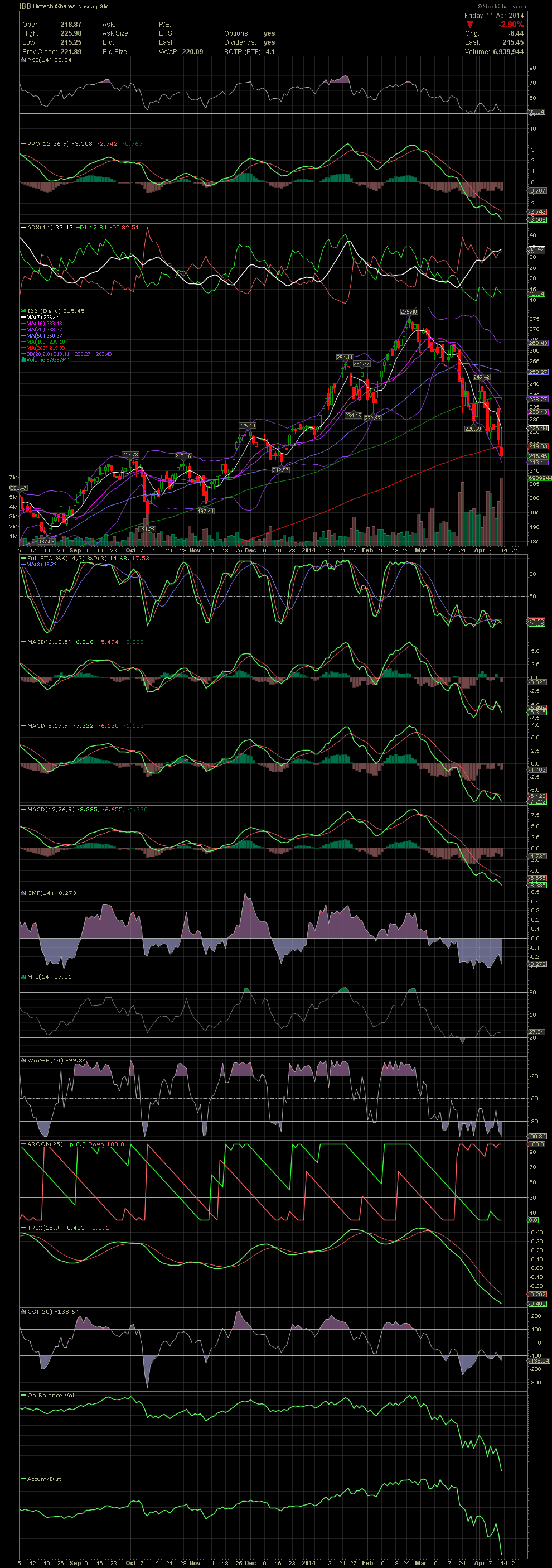

Biotech/Pharma Sector ~ IBB as an Example

The bio/pharma sector, which many of us traded very successfully over the last few months, has been in a red waterfall for weeks. Those who are attempting to catch the falling knife are getting sliced up badly. Below is the IBB Daily Chart, and one can clearly see the sell signals which began in late Feb/early March. Just look at the FullSto and MACD negative crossovers to the downside. There has been nothing near a buy signal since and the index broke thru all moving averages, the 50, 100, and now the 200, over the last couple of weeks. Friday's move and close below the MA200 will have to be watched carefully this week to see if the bleeding continues or begins to stabilize at or above the previous low of 212 established in late Dec. If that breaks, then pick your own targets below that level. The increased volume over the last three weeks is a signal how the sheeple fund managers also tend to panic when they all begin chasing each other out the door. Note the fairly low volume, in comparison, when the index was hitting new highs daily. Too funny! Reminds me exactly of how penny players invest, right? GLTA

The bio/pharma sector, which many of us traded very successfully over the last few months, has been in a red waterfall for weeks. Those who are attempting to catch the falling knife are getting sliced up badly. Below is the IBB Daily Chart, and one can clearly see the sell signals which began in late Feb/early March. Just look at the FullSto and MACD negative crossovers to the downside. There has been nothing near a buy signal since and the index broke thru all moving averages, the 50, 100, and now the 200, over the last couple of weeks. Friday's move and close below the MA200 will have to be watched carefully this week to see if the bleeding continues or begins to stabilize at or above the previous low of 212 established in late Dec. If that breaks, then pick your own targets below that level. The increased volume over the last three weeks is a signal how the sheeple fund managers also tend to panic when they all begin chasing each other out the door. Note the fairly low volume, in comparison, when the index was hitting new highs daily. Too funny! Reminds me exactly of how penny players invest, right? GLTA