Posted On: 04/02/2014 3:48:59 PM

Post# of 36729

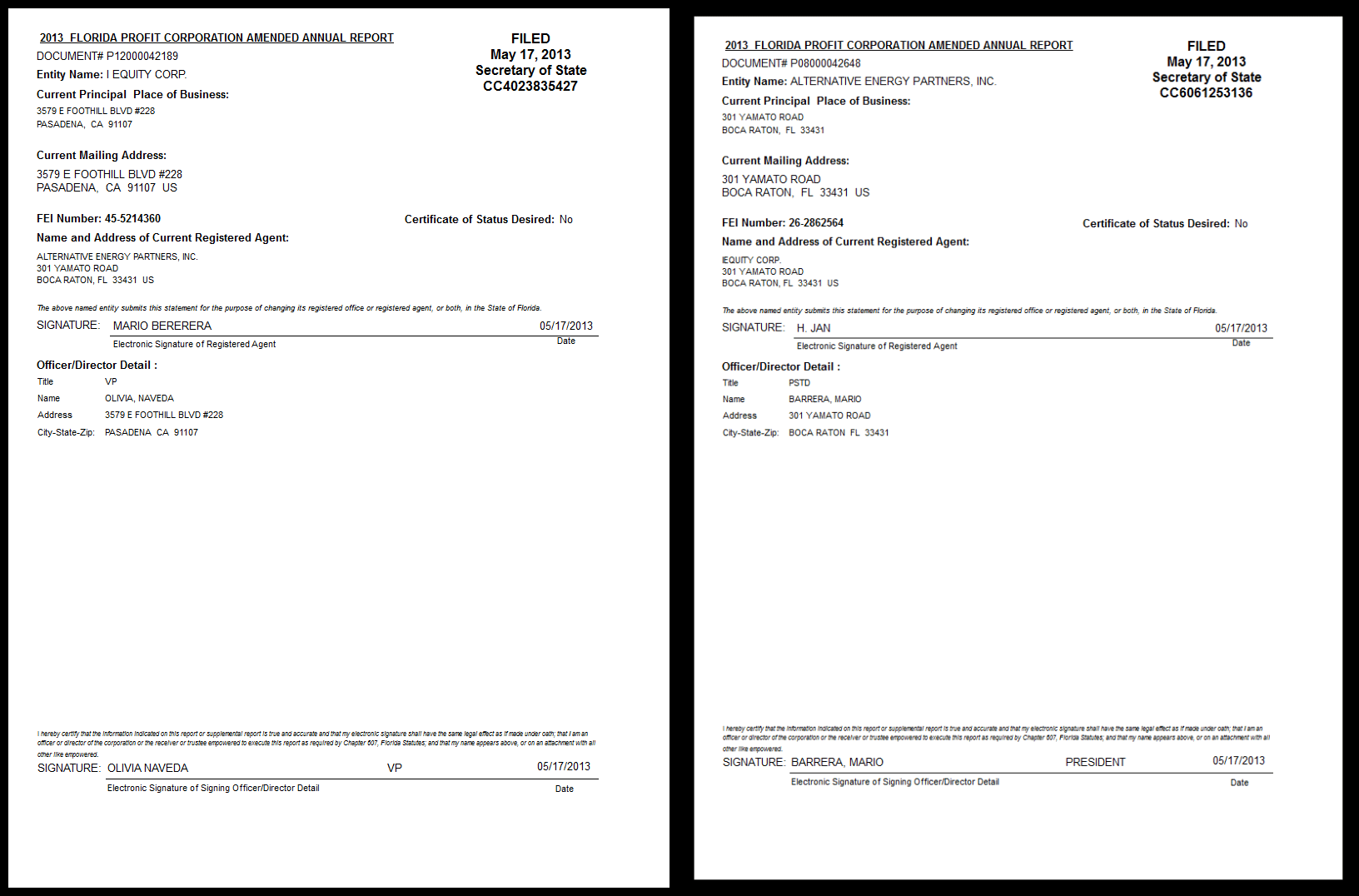

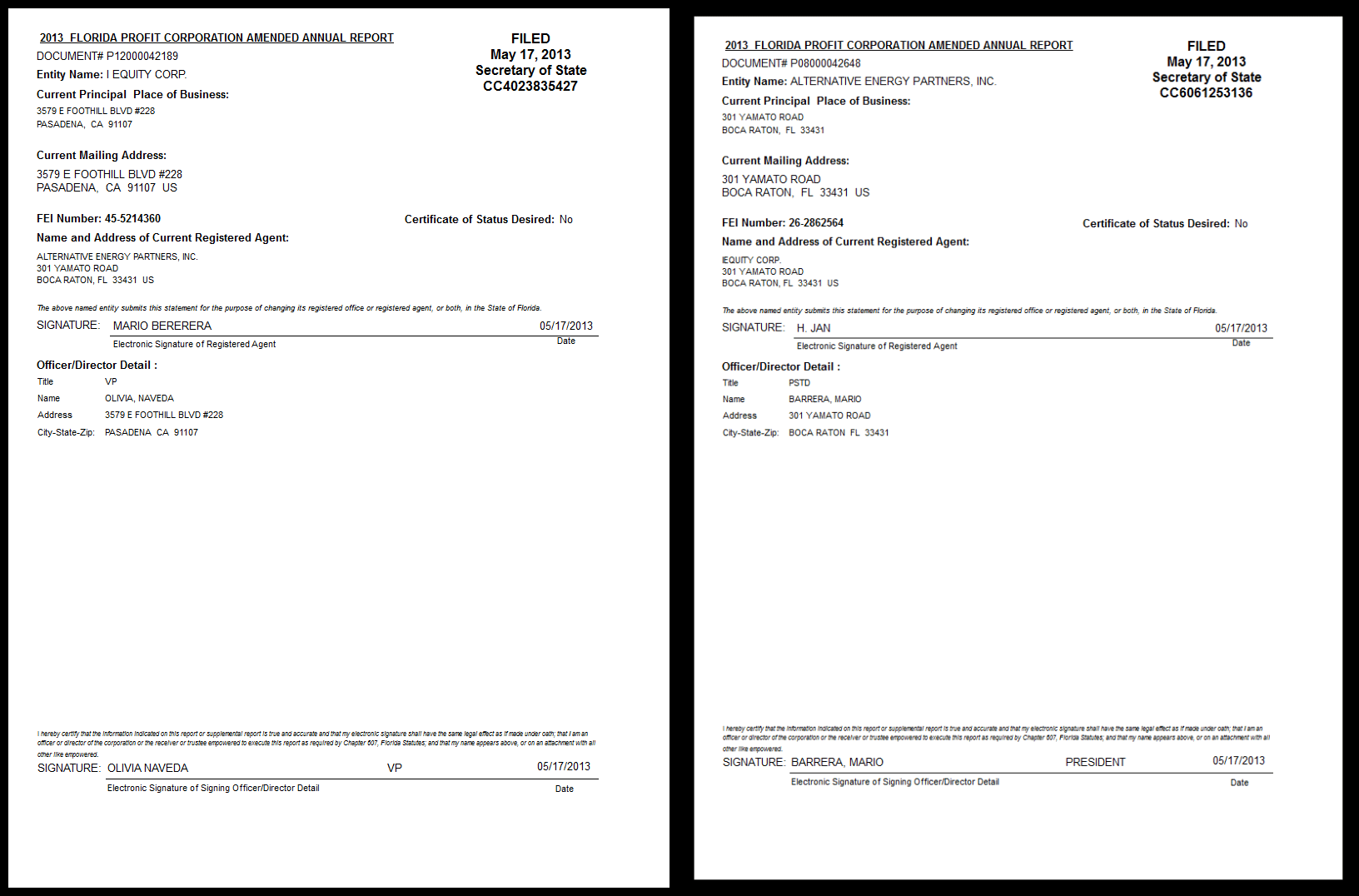

Temporary dip down until SK issues its EOY. It doesn't change the circumstance that you can't blame AEGY holders from pumping their 5 billion A/S financially crippled company with its blatant red flag control issues. And how does AEGY's Mario Barerra and John F. Burke explain that MI Financial Services, Inc, registered agent for AEGY, does not exist in the FL corporate data base or anywhere else as a corporation? See attachment.

AEGY: "During the six months ended January 31, 2014, we issued 1,339,318,962 common shares resulting from conversions of outstanding notes resulting in total common shares outstanding at January 31, 2014 of 2,164,853,983 shares."

In the next three months, AEGY issued another 1.4 Billion shares:

AEGY: As of March 17, 2014, there were 3,553,421,246 shares of our common stock outstanding, held by 142 shareholders of record.

AEGY: "As of July 31, 2013, the fair value of the Company 's derivative liabilities was $2,643,904 and $2,205,740 was recognized as a gain on derivatives due to change in fair value of the liability during the year ended July 31, 2013." What?

AEGY: "During the six months ended January 31, 2014, we issued 1,339,318,962 common shares resulting from conversions of outstanding notes resulting in total common shares outstanding at January 31, 2014 of 2,164,853,983 shares."

In the next three months, AEGY issued another 1.4 Billion shares:

AEGY: As of March 17, 2014, there were 3,553,421,246 shares of our common stock outstanding, held by 142 shareholders of record.

AEGY: "As of July 31, 2013, the fair value of the Company 's derivative liabilities was $2,643,904 and $2,205,740 was recognized as a gain on derivatives due to change in fair value of the liability during the year ended July 31, 2013." What?