Posted On: 03/09/2014 9:06:57 PM

Post# of 2561

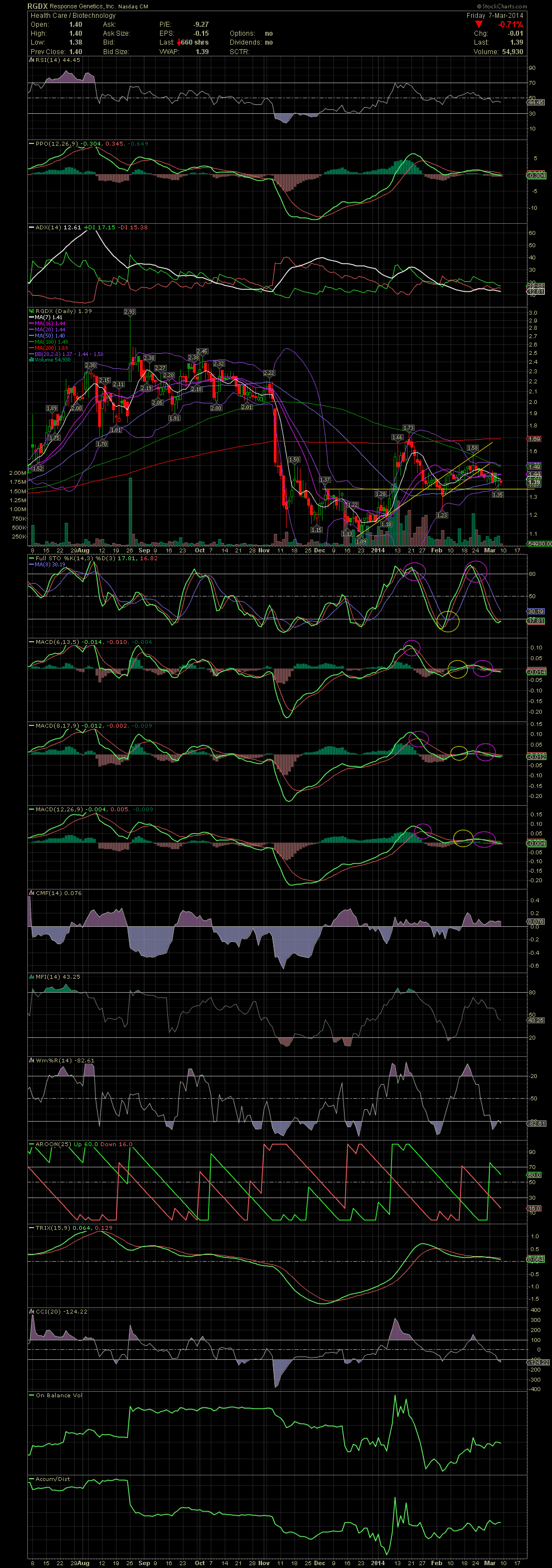

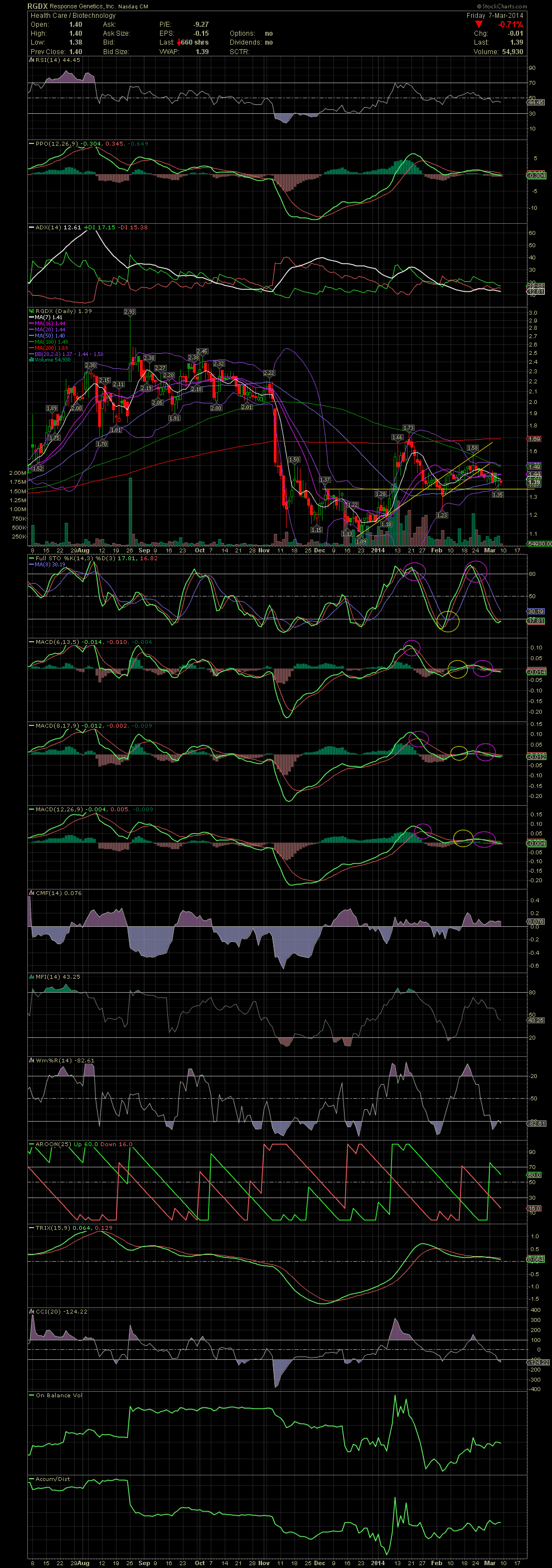

RGDX Daily Chart ~ Trending to the Downside

Link back to my comments of March 2. I have not yet re-entered RGDX although I'm watching closely. Once the FullSto and MACDs gave a negative crossover, I sold the balance of my shares (link back). Since then the stock has fallen for its first test of the lower trendline at 1.35. The FullSto is in oversold territory and begin to curl to the upside. The MACDs aren't there yet although tight. RGDX could give us a quick pop to the upside as news is pending. If I decide to enter in the next day or two, I'll probably only allocate 30-50% in the mid 1.30s. If the lower channel line is broken, I would expect to see the 1.23/1.25 are tested. So the downside, imo, is approx .10 while the upside is probably the high 1.60s/low 1.70s as was seen in mid January. RGDX on watch. GLTA

Link back to my comments of March 2. I have not yet re-entered RGDX although I'm watching closely. Once the FullSto and MACDs gave a negative crossover, I sold the balance of my shares (link back). Since then the stock has fallen for its first test of the lower trendline at 1.35. The FullSto is in oversold territory and begin to curl to the upside. The MACDs aren't there yet although tight. RGDX could give us a quick pop to the upside as news is pending. If I decide to enter in the next day or two, I'll probably only allocate 30-50% in the mid 1.30s. If the lower channel line is broken, I would expect to see the 1.23/1.25 are tested. So the downside, imo, is approx .10 while the upside is probably the high 1.60s/low 1.70s as was seen in mid January. RGDX on watch. GLTA