Posted On: 03/02/2014 6:58:25 PM

Post# of 2561

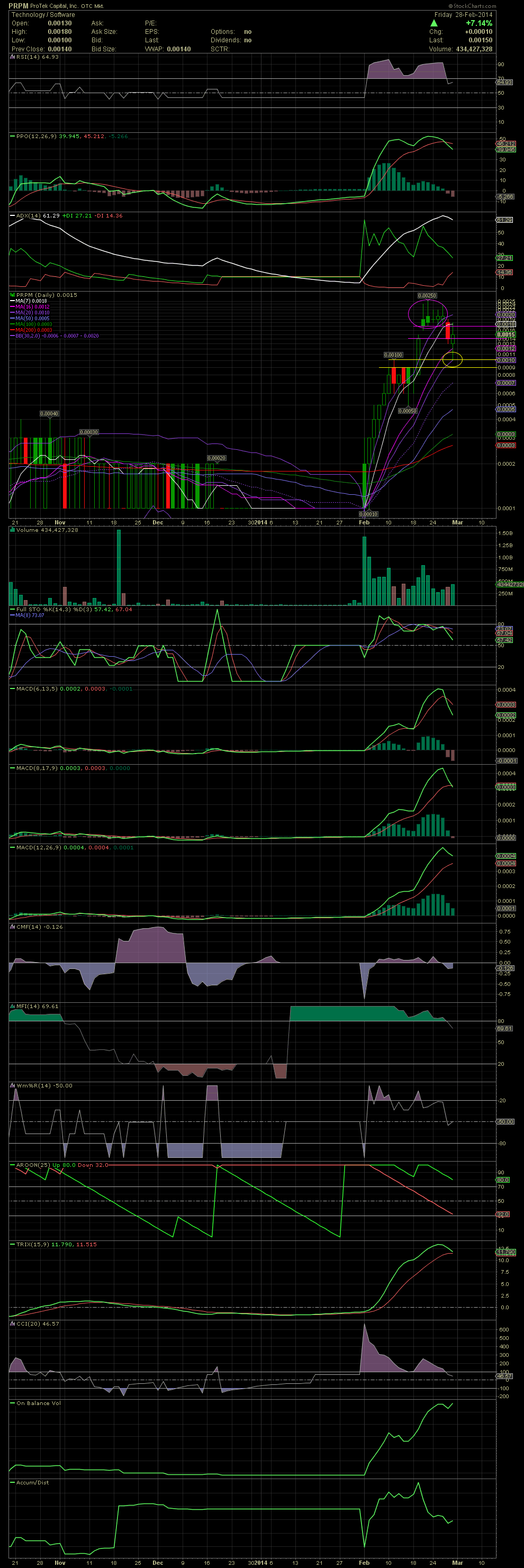

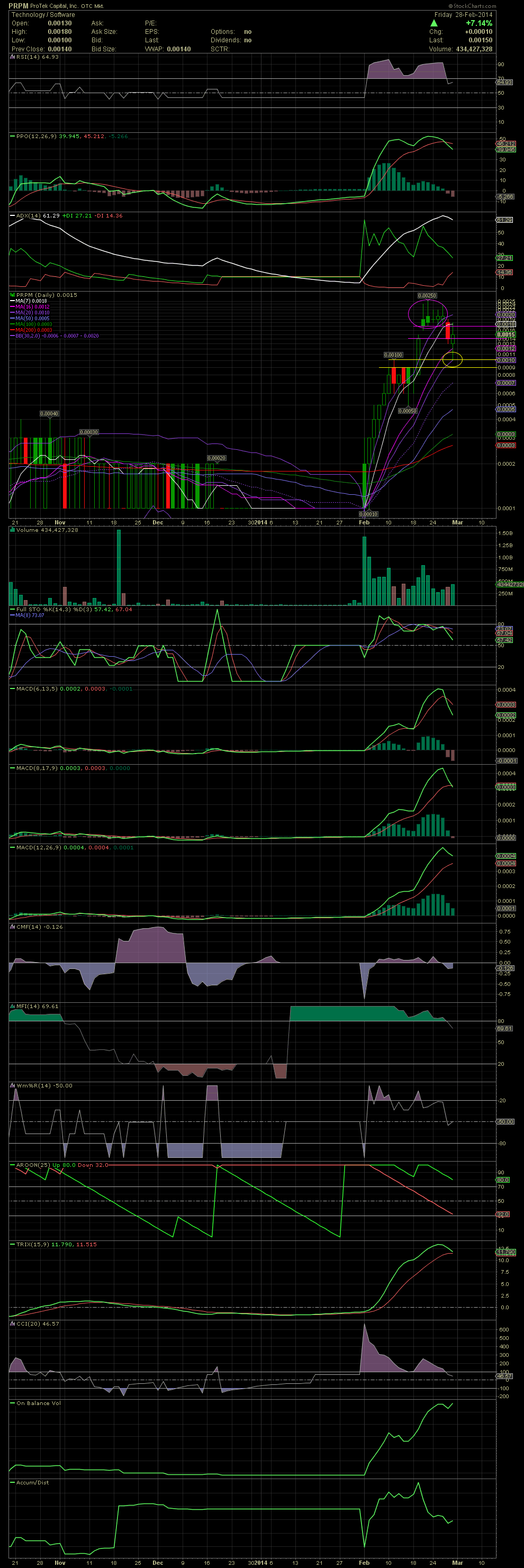

PRPM Daily Chart ~ Back Inside the Bollies and Looking for Support

This stock has been a beast for the month of February. The brief consolidation at .0009/.001 in mid month was followed with a run to .0026. I circled the five days of trading outside the upper bollie. Again, the prudent thing to do is to take a few off when that occurs. When a stock comes back inside the bollies, then you'll usually have some powder to buy back if you chose to do so. And with the FullSto and MACDs at very high levels when the stock was outside the bollie, it only made sense to sell a few. When that happens, then it's time to look for a re-enter to flip that portion again. When PRPM began pulling back it held and closed at .0014 (a previous closing high) at its first line of support. Friday saw the stock break lower to its next support lines, .001 and .0011. I put an order in at .0011 while holding a core position. So in case the stock didn't drop, at least I still had a good amount for the future, as I believe PRPM with its new management is doing things right. But rest assured, I'll always have my sell finger ready if the trading goes bad. I continue to treat PRPM as a high risk/high reward stock, but I'm on freebies since .002-.0022. My trade on Friday was for a calculated entry at .0011 based solely on the chart with a predetermined exit at .0016/.0017, which I entered immediately upon the buy of .0011. I wished it was always this easy, but sadly, it's not. GLTA

This stock has been a beast for the month of February. The brief consolidation at .0009/.001 in mid month was followed with a run to .0026. I circled the five days of trading outside the upper bollie. Again, the prudent thing to do is to take a few off when that occurs. When a stock comes back inside the bollies, then you'll usually have some powder to buy back if you chose to do so. And with the FullSto and MACDs at very high levels when the stock was outside the bollie, it only made sense to sell a few. When that happens, then it's time to look for a re-enter to flip that portion again. When PRPM began pulling back it held and closed at .0014 (a previous closing high) at its first line of support. Friday saw the stock break lower to its next support lines, .001 and .0011. I put an order in at .0011 while holding a core position. So in case the stock didn't drop, at least I still had a good amount for the future, as I believe PRPM with its new management is doing things right. But rest assured, I'll always have my sell finger ready if the trading goes bad. I continue to treat PRPM as a high risk/high reward stock, but I'm on freebies since .002-.0022. My trade on Friday was for a calculated entry at .0011 based solely on the chart with a predetermined exit at .0016/.0017, which I entered immediately upon the buy of .0011. I wished it was always this easy, but sadly, it's not. GLTA

| 02/28/14 | Sold | 1,000,000 of PRPM @ $0.0016 | 1,591.98 |

| 02/28/14 | Sold | 2,000,000 of PRPM @ $0.0016 (Order #749) | 3,191.95 |

| 02/28/14 | Sold | 1,000,000 of PRPM @ $0.0016 (Order #747) | 1,591.98 |

| 02/28/14 | Sold | 1,000,000 of PRPM @ $0.0017 | 1,691.98 |

| 02/28/14 | Bought | 5,000,000 of PRPM @ $0.0011 (Order #742) | -5,507.99 |