Posted On: 12/05/2013 1:32:01 AM

Post# of 72451

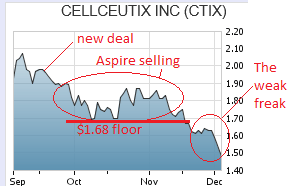

I figured some questions could be answered using logic: We know from the Dec. 10th PR that Aspire has agreed to make common stock purchases up to $10 million. ( http://cellceutix.com/cellceutix-enters-into-...-fund-llc/ )

As of September 30, 2013, the Company had completed sales to Aspire totaling 4,812,208 shares of common stock generating gross proceeds of approximately $8,113,000 - this statement is from the recent quarterly at http://www.sec.gov/Archives/edgar/data/135525...0q2q13.htm

That is an average stock price of $8,113,000/4,812,208=$1.686. A new agreement comes about and Aspire must liquidate this risk knowing that they will be requested to by up to $20 million in the future. So, Aspire sells down to 1.68 rather than support the price like they have been doing for the last year while CTIX requires them to buy common stock. The resulting decline then worries the weak and we continue to drift below the Aspire price.

What happens in the future is Aspire is required to support the price again by making common stock buys. Until then, get 'em while they're cheap!

As of September 30, 2013, the Company had completed sales to Aspire totaling 4,812,208 shares of common stock generating gross proceeds of approximately $8,113,000 - this statement is from the recent quarterly at http://www.sec.gov/Archives/edgar/data/135525...0q2q13.htm

That is an average stock price of $8,113,000/4,812,208=$1.686. A new agreement comes about and Aspire must liquidate this risk knowing that they will be requested to by up to $20 million in the future. So, Aspire sells down to 1.68 rather than support the price like they have been doing for the last year while CTIX requires them to buy common stock. The resulting decline then worries the weak and we continue to drift below the Aspire price.

What happens in the future is Aspire is required to support the price again by making common stock buys. Until then, get 'em while they're cheap!