THERE'S A HUGE STORM BREWING AT Q LOTUS HOLDINGS,INC >QLTS<

Q Lotus Holdings Inc. (QLTS) Company Website > http://www.qlotuspe.com/

http://www.qlotuspe.com/news/Q_Lotus-press_re....04.14.pdf

Q Lotus Holdings, Inc. (QLTS, "the Company"

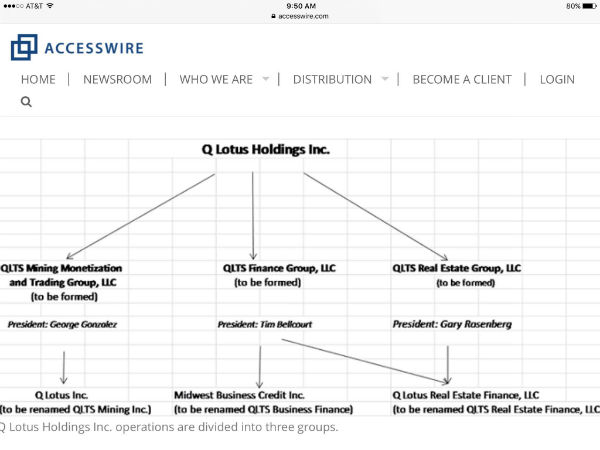

Trading and Monetization. The Company maintains a network of respected trading capabilities in the United States and in other parts of the world. The Company’s trading teams are working with the Mining group to determine most advantageous utilizations of the Company’s valuable mining claims while establishing other trading opportunities.

Real Estate . Q Lotus Real Estate Finance, LLC, a wholly owned subsidiary of the Company, consists of a team of sophisticated, experienced and respected professionals in all facets of real estate. The group is a real estate developer and a provider of financial and other services to the real estate industry . Q Lotus Real Estate Finance, LLC is the manager of development for the Company’s two major real estate projects: the Port of Fort Pierce Project in Fort Pierce, Florida, which will be designed and built as a “port of tomorrow” with technological advancements imbedded throughout every operation and physical aspect of the port, and the Lake Zurich Entertainment Complex Project, in Lake Zurich, Illinois which is being designed to become one of the top entertainment venues in the Midwest .

Lending. Midwest Business Credit Inc., a wholly owned subsidiary of the Company, is a non-regulated cash generating finance company that specializes in asset-based commercial lending and financing real estate and other activities where the Company has meaningful interests and expertise. Midwest Business Credit Inc. capitalizes on the outstanding long term track record of its team.

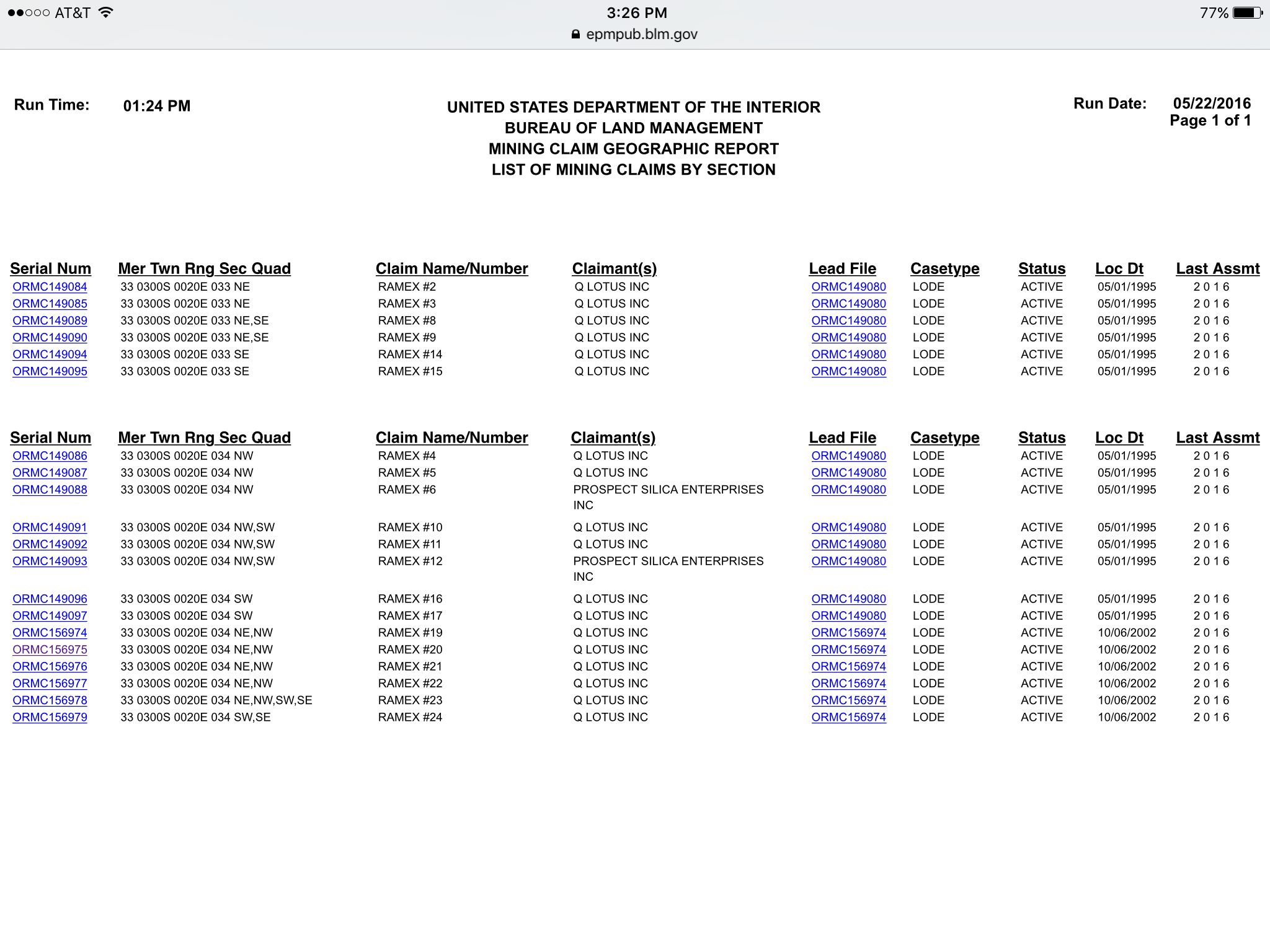

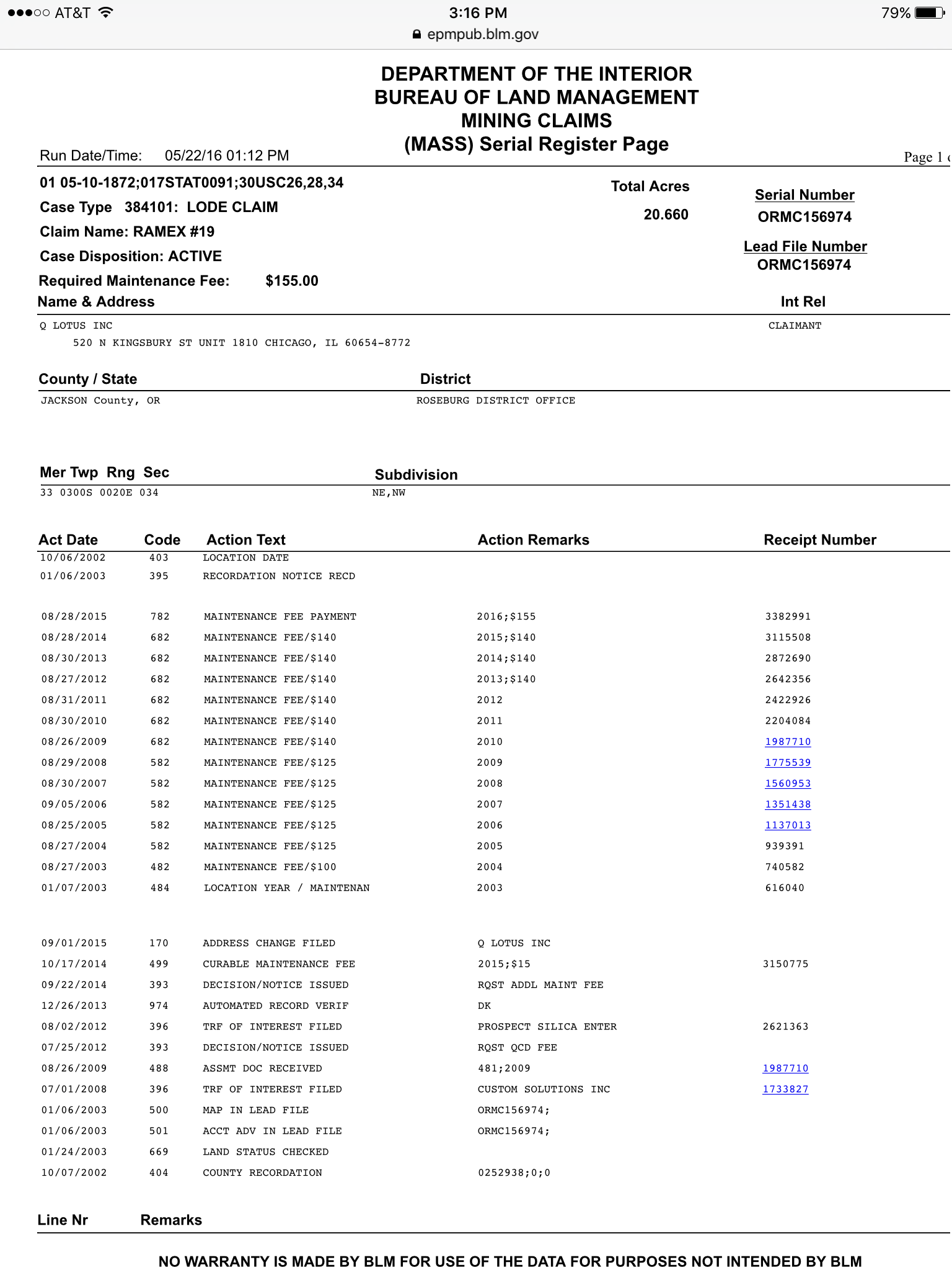

Mining. The Company owns 20 valuable silica mining claims nested in the State of Oregon. Initial studies have indicated high purity for the silica and the Company is engaging qualified consultants to do updated valuations and complete a bulk sampling program to determine the consistency of the purity and the local marketability of the Company’s Silica Mining claims.

International. The Company has strong support from shareholders in India and Nigeria, who are working with the Company’s International Team to create advantageous synergies and business opportunities. India and Nigeria are expected to have the most rapidly growing economies in the world, other than the United States and China.

The Company’s objective is to create value for its shareholders by creating growing streams of income and cash flow and facilitating increases in value of its retained assets.

Bio - Gary A. Rosenberg Chairman / President and Director

Has been a securities lawyer for the SEC in Washington D.C. and in private practice in Chicago. Mr. Rosenberg has extensive senior executive experience managing, directing, financing and forming publicly held and private companies. Mr. Rosenberg founded Universal Development Corporation in 1970. As Chairman and CEO, he led the company to become listed on the NYSE while experiencing uninterrupted increases in income for twenty straight years. As a securities Principal, he formed and became the first President of Olympic Cuascade Financial Corporation, now known as National Holdings Corporation, and he later became the Chairman of its Audit Committee. Mr. Rosenberg has also been a founder, manager, and/or director of several venture capital companies and financial institutions of both public and private ownership. He has been a major player in the real estate industry with numerous accomplishments which can be found on his website at www.GaryRosenberg.net. In more than four decades of real estate development he has never failed to complete a project . Mr. Rosenberg is also highly regarded as a leader and innovator in finance and education, having created and taught the real estate program in the Finance Department at the highly ranked Kellogg Graduate School of Management.

www.qlotuspe.com/bio_rosenberg.php

Dear Friends and associates of Q Lotus Holdings Inc.,

I am very pleased to announce that the Board of Directors of Q Lotus Holdings Inc. had a meeting this past Monday, May 16 2016, at which the directors unanimously elected Timothy D. Bellcourt to become the Chief Executive Officer of Q Lotus Holdings Inc.

I believe you are all aware of Mr. Bellcourt’s outstanding capabilities and accomplishments as a banker and in the world of finance. For your convenience and recollection, I am including herewith a condense review of Timothy D. Bellcourt’s background. I will remain the Chairman and President of Q Lotus Holdings Inc. and the other members of our executive team, Jorge E. Gonzalez Chief Financial Officer and Daniel Kurzweil Chief Operating Officer remain in their current positions. Your executive team is working cooperatively and diligently under the guidance of the Q Lotus Holdings Inc. Board of Directors to see that the promised funds to Q Lotus Holdings Inc. are brought to fruition.

Timothy Bellcourt with over 25 years of experience in the asset-backed lending industry, and a track record with a loan loss ratio of less than 1%, has been involved in audit management, loan administration, portfolio management, credit underwriting, marketing, and profit and loss responsibilities. He has worked for organizations such as LaSalle Business Credit, GE Capital Corporation, and US Bank. Tim has also successfully founded two independent asset-backed lending companies.

As I first indicated in my letter in March 24th, executing Q Lotus funding has been and is very time consuming and complicated, requiring a high level of expertise for its completion. Tim brings that expertise to the table to be able to get funding started and brought to completion. Because of Tim’s skills and contacts in financing, as well as, his skills as a manager, he has been able to obtain the recognition and support from all parties including Harvesttime Worldwide Oil Trust London, LLC and Wild Stallions, LLC to accomplish successful financing.

Please join me in congratulating Tim for his election as Chief Executive officer of Q Lotus Holdings Inc. and offer him your full support.

Thank you for your continued interest and support. Please don’t hesitate to contact me with any questions you may have.

Sincerely,

Gary A. Rosenberg

Chairman & President

Q Lotus Holdings Inc.

P: (773) 857-1415

C: (312) 498-0301

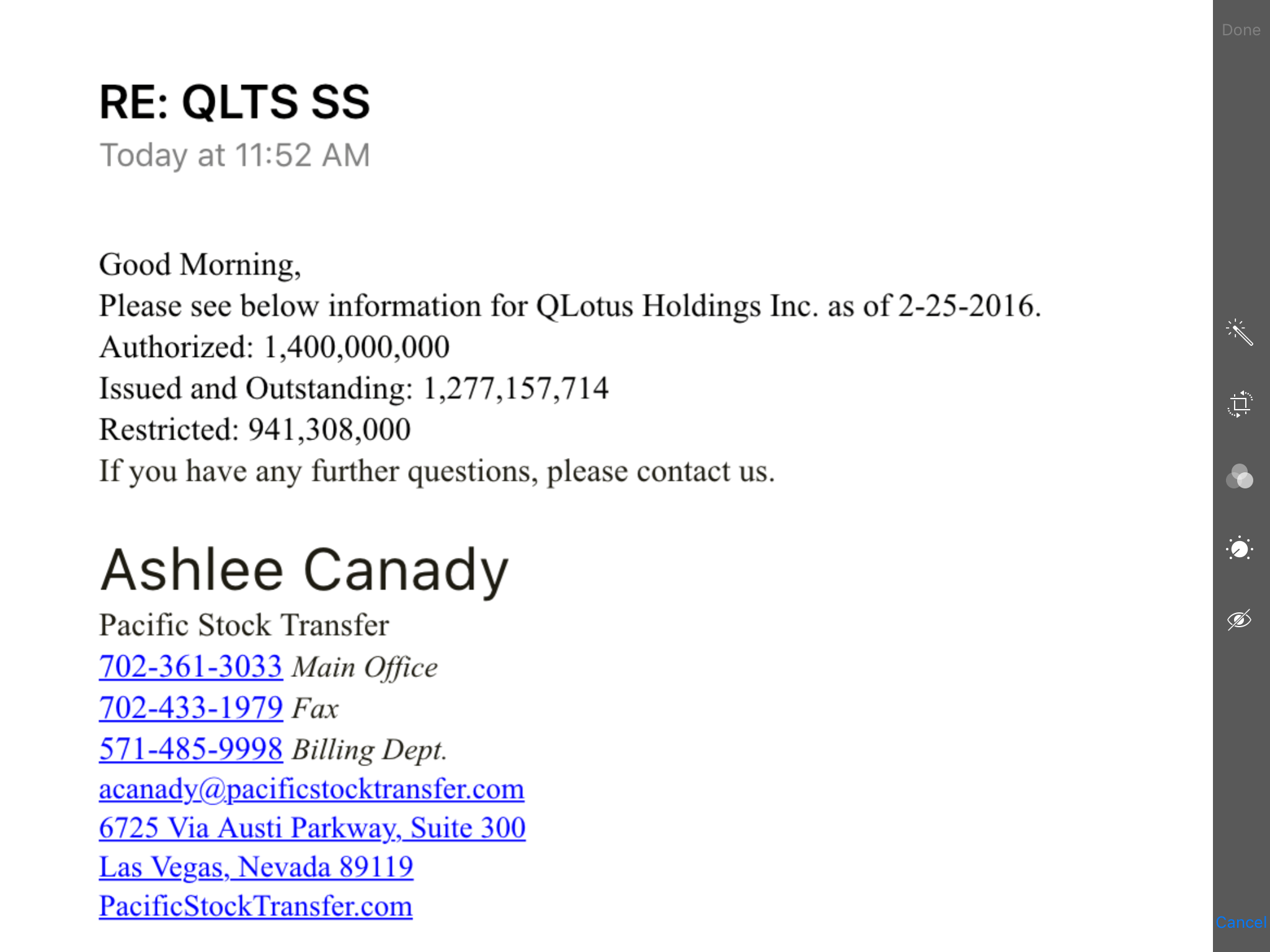

RE: QLTS SS Update 1-7-17

Good Morning,

Please see below information for Q Lotus Holdings Inc. as of 1-7-17

Authorized: 1,400,000,000

Issued and Outstanding: 1,277,157,714

Restricted: 941,308,000

If you have any further questions, please contact us.

Ashlee Canady

Pacific Stock Transfer

702-361-3033 Main Office

702-433-1979 Fax

571-485-9998 Billing Dept.

acanady@pacificstocktransfer.com

6725 Via Austi Parkway, Suite 300

Las Vegas, Nevada 89119

PacificStockTransfer.com

Float: 335,849,714

FLOAT HAS BEEN UNCHANGED SINCE JUNE 2014

NO DILUTION, NO TOXIC DEBT OR HIDDEN RULES 44...

Edgar-Online all Fillings:

http://yahoo.brand.edgar-online.com/default.aspx?cik=1391142

SEC Filings > Form 4s - Huge Amounts Of Restricted Shares owned by insiders....

Courtesy Sib

GOLDSTEIN + GOLDSTEIN FAMILY PARTNERSHIP II, L.P.:

SC 13D/A May 05 2014:

ITEM 3. Source and Amount of Funds or Other Consideration

The Reporting Person purchased the shares of Common Stock of the Issuer pursuant to six securities purchase agreements with the Issuer for an aggregate of $325,000. All funds used in such securities purchase agreements were obtained through the personal funds of the Reporting Person.

ITEM 4. Purpose of Transaction

The Reporting Person purchased the shares of Common Stock of the Issuer for investment purposes.

http://www.sec.gov/Archives/edgar/data/139114...in_da2.htm

Secretary of State

Nevada State Capitol Building

101 North Carson Street, Suite 3

Carson City, NV 89701

Phone: 775-684-5708

FAX: 775-684-5725*

Email: sosmail@sos.nv.gov

http://nvsos.gov/sosentitysearch/CorpDetails....%253d%253d

http://nvsos.gov/sosentitysearch/CorpDetails....&nt7=0

QLTS Stock Score > https://www.stockscores.com/quickreport.asp?t...11&y=2

QLTS BARCHART > http://www.barchart.com/cheatsheet.php?sym=QLTS

QLTS- Targets > http://www.allotcbb.com/quote.php?symbol=qlts

QLTS Time & Sales >

http://www.investorpoint.com/stock/QLTS-Q+Lot...rs-level2/

OTC SHORTREPORT

http://otcshortreport.com/index.php?index=QLT...ction=view

Posted By: wayno2

3/24/16 Dear Friends and associates of Q Lotus Holdings Inc.

Its’ been four weeks since my last letter. I apologize for the absence of more frequent communications. However, a quiet period has been required to allow time for the process to fully congeal for meaningful and appropriate communication. While Q Lotus financing is creative and powerful, it is also very complicated and highly technical. It has required a period of time to bring all of the pieces together and to take it to proper pathways which can assure its total success.

I am pleased to be able to relay to you our most recent report from the Harvesttime Worldwide Oil Trust London, LLC and Wild Stallions, LLC trading team. They have advised that they are in final negotiations to complete the precise funding tranches which will generate the cash to meet their $75,000,000 commitment to Q Lotus Holdings Inc., and that the finalization of the tranches is in the last stage of the process. Q Lotus Holdings Inc. will advise upon final agreement of the tranches and as funding is received. http://investorshangout.com/post/view?id=3580637

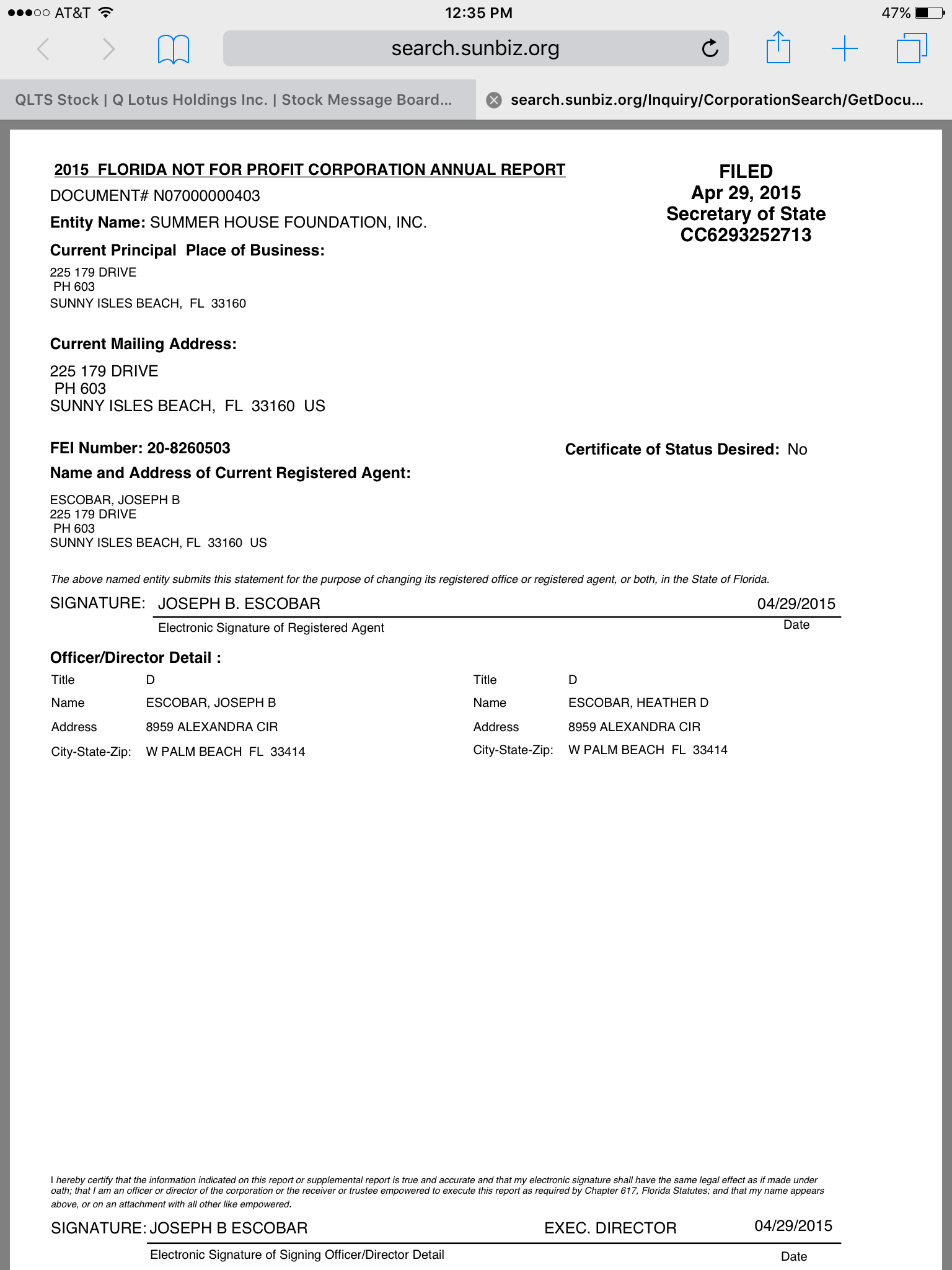

I am also pleased to be able to update you on the status of the purchase by Wild Stallions, LLC of 30,000,000 shares of Q Lotus Holdings Inc. common stock at $1.00 per share. Wild Stallions is purchasing the stock through its affiliated entity, The Summer House Foundation, Inc. a copy of the fully executed stock purchase agreement is attached hereto. http://investorshangout.com/post/view?id=3640730 Wild Stallions is in the process of finalizing the funding for those shares. There are no guarantees as to the timing of payment, however, Q Lotus will advised when payments are received. SS link http://investorshangout.com/post/view?id=3641715

Thank you for your continued interest and support. Please don’t hesitate to contact me with any questions you may have.

Sincerely,

Gary A. Rosenberg

Chairman and CEO

SECURITIES PURCHASE AGREEMENT! 3-24-16

This Securities Purchase Agreement (this "Agreement"

WHEREAS, Purchaser desires to acquire equity securities of the Issuer and the Issuer desires to issue and sell them to Purchaser..

http://investorshangout.com/post/view?id=3640730

February 26, 2016

Dear Friends and Associates of Q Lotus Holdings Inc.,

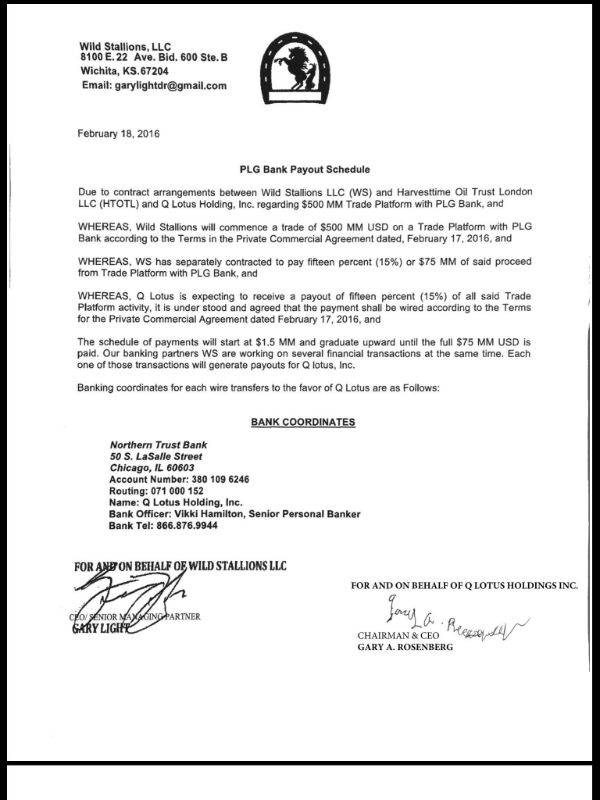

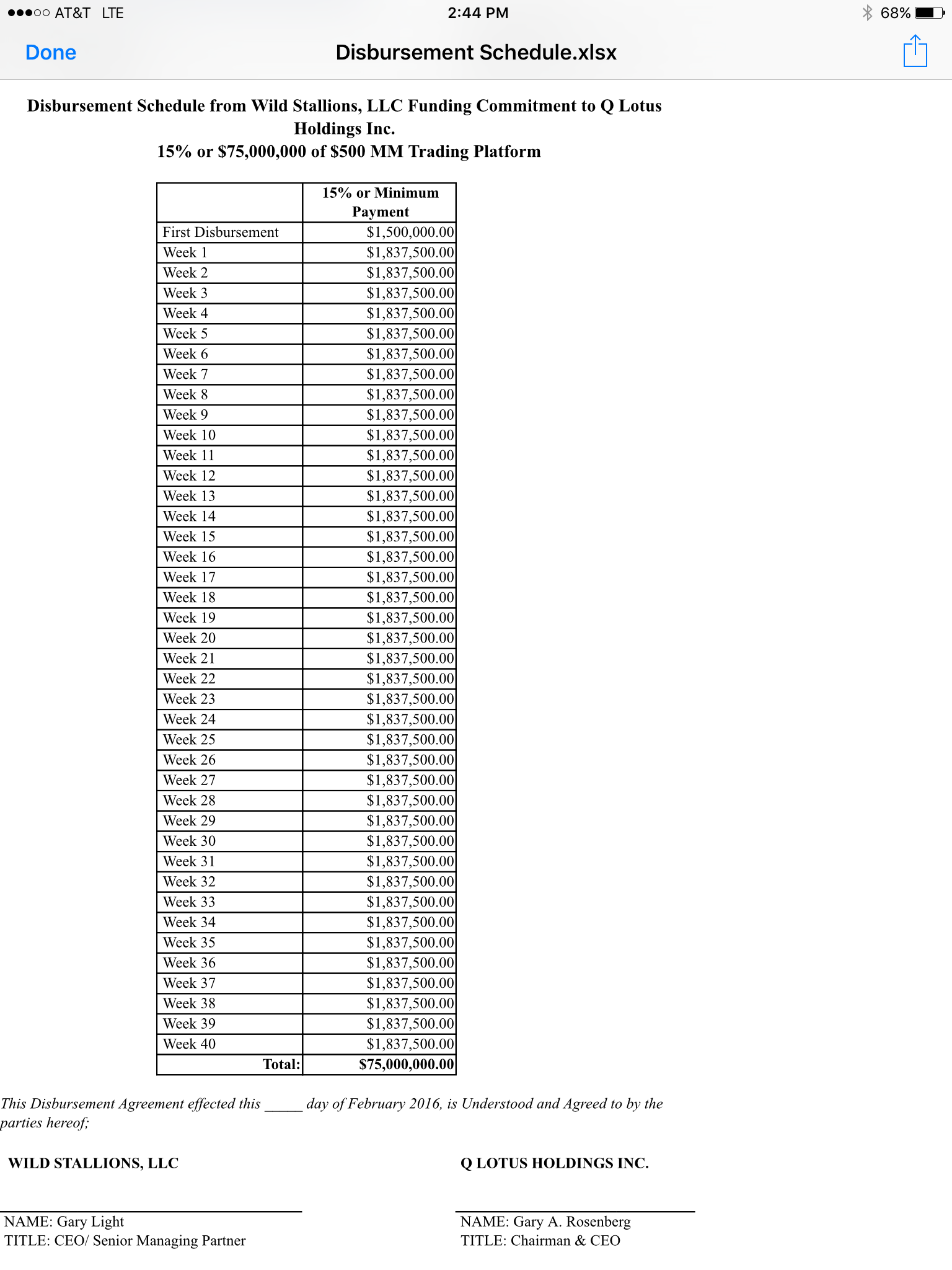

We are finalizing the agreements and procedures for the proper funding of the $75 MM commitment from Wild Stallions, LLC to Q Lotus Holdings Inc. To bring you fully up to date, I have included a copy of the Payout Commitment Letter from Wild Stallions, LLC to Q Lotus Holdings Inc. along with a copy of our currently proposed Funding Disbursement Agreement which is in the process of final approval by Wild Stallions, LLC. These steps are directed towards ultimately completing the capacity necessary for full funding of both, the Q Lotus Holdings Inc. business plan and its various projects, as well as repayment of loans with appropriate returns.

Thank you for your continued support. I will be issuing an update by the middle of the week.

Sincerely,

Gary A. Rosenberg

Chairman and CEO

2-19-16 Dear Friends and Associates of Q Lotus Holdings Inc.,

The Trading and Monetization team has advised that cash distributions in payment of the $75,000,000 commitment from Wild Stallions, LLC will commence next week. The team is finalizing the contract governing the distribution schedule.

We will file reports when and as funds are received.

Thank you for your continued interest and support in Q Lotus Holdings Inc.

Have a good weekend!

Sincerely,

Gary A. Rosenberg

Chairman and CEO

Q Lotus Holdings Inc.

2-12-16 > Dear Friends and Associates of Q Lotus Holdings Inc.,

In my last letter to you, I referred to the work of Wild Stallions, LLC with Q Lotus and Harvesttime to establish a worldwide network in connection with the execution of the trading and monetization activities. It has become apparent that it would be beneficial to Q Lotus if Wild Stallions itself became further integrated with Q Lotus to facilitate the best results in ongoing activities of all three companies.

While greater integration benefits Q Lotus and Harvesttime, it also benefits Wild Stallions. Wild Stallions is seeking a substantial interest in Q Lotus along with the opportunity to meet all of Q Lotus funding needs. Accordingly, Wild Stallions has committed to invest $30,000,000 by way of a purchase of 30,000,000 shares of common stock of Q Lotus Holdings Inc. ($1.00 a share). Q Lotus and Wild Stallions are in the process of finalizing documentation and closing.

It is expected that Q Lotus and Harvesttime will continue to utilize the capabilities of Wild Stallions to finance various projects as it was previously established, funding for the following projects:

The Port of Fort Pierce project in Florida

The Lake Zurich Entertainment Complex project in Lake Zurich, Illinois

The realization from the Silica Mining Claims in Oregon

And any and all other approved projects.

The 30,000,000 share purchase of Q Lotus Holdings Inc. common stock is independent of the $75,000,000 commitment from Wild Stallions, LLC which is being funded through the team’s trading and monetization activities.

We expect to provide frequent updates as our activities progress.

Sincerely,

Gary A. Rosenberg

Chairman and CEO

Q Lotus Holdings Inc.

1-12-16

Dear Friends and Associates of Q Lotus Holdings Inc.,

In my last letter to you, I reported that we have negotiated a one billion dollar financing for the Port of Fort Pierce Project in Florida. I’m pleased to advise that the documentation for the financing is moving forward with all parties in agreement. I am expecting all documents to be finalized and ready for an 8K filing sometime next week.

In addition, we have been advised that the same funding source will fully fund the Lake Zurich Entertainment Complex Project.

This increased capacity facilitates more rapid growth in all of our profit centers: Lending, Mining, Monetization, Trading and International as well as Real Estate.

Q Lotus Holdings Inc. expects to receive its $75,000,000 business plan funding proceeds in tranches over the next three weeks. I will keep you advised in that regard and updates will be provided as events occur.

Sincerely,

Gary A. Rosenberg

Chairman and CEO Q Lotus Holdings Inc.

1-5-16 Q Lotus Holdings Inc. QLTS 9:27 AM

Dear Friends and Associates of Q Lotus Holdings Inc.

Iwant to wish you all a very happy and prosperous New Year. We are looking forward to a dynamic year for growth and success for Q Lotus Holdings Inc. and will endeavor, as always, to keep you well advised of our progress.

We have good news to start the New Year, Q Lotus and Harvesttime has negotiated a one billion dollar financing for the Port of Fort Pierce Project in Florida. Definitive agreements and documentation of the financing is in progress and upon its completion, an appropriate 8k filling will be made with the Securities and Exchange Commission.

We look forward to keeping you updated regarding this project and other activities of Q Lotus Holdings Inc. over the course of the year.

Sincerely,

Gary A. Rosenberg

Chairman and CEO Q Lotus Holdings Inc

December 8, 2015

Dear friends and associates of Q Lotus Holdings Inc.

Q Lotus Holdings Inc. continues to make progress in creating value for the company through its Trading and Monetization Group working in conjunction with its partners, Harvesttime Worldwide Oil Trust London, LLC.

As we announced in our recent Press Release on November 23, 2015, the $500,000,000 financial instrument has been obtained and is being monetized. At the same time, Harvesttime has agreed to share, on an equal basis, with Q Lotus Holdings Inc. the returns of its gold resource activities in Ghana. Q Lotus Holdings Inc. will be paid the first $75,000,000 generated by all monetization activities, which we expect to be paid during the holiday season. Additional funds that are generated will be utilized to jointly develop projects and opportunities with Harvesttime.

I want to wish you a very happy holiday season and look forward to advising you when funds are received.

Please feel free to call me at 312-498-0301.

Sincerely,

Gary A. Rosenberg Chairman and CEO

Q Lotus Holdings Inc.

520 N. Kingsbury St, # 1810

Chicago IL, 60654

P: (312) 379-1800

C: (312) 498-0301

QLTS- Press Release November 23, 2015

Q Lotus Holdings Inc. Trading and Monetization Team Obtains $500 Million Financial...

http://finance.yahoo.com/news/q-lotus-holding...NlYwNzcg--

http://finance.yahoo.com/q?s=qlts

Courtesy gator11

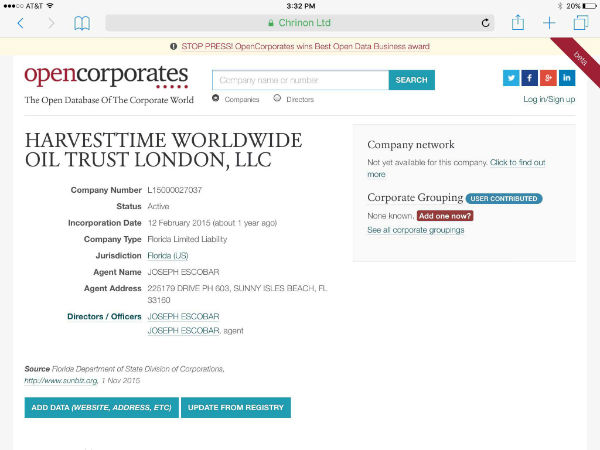

HARVESTTIME WORLDWIDE OIL TRUST LONDON, LLC

https://opencorporates.com/companies/us_fl/L15000027037

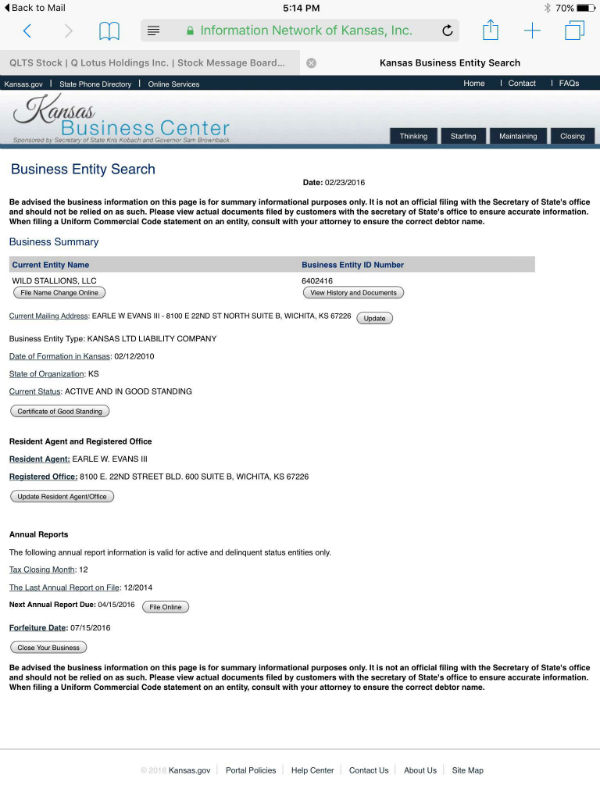

WILD STALLIONS, LLC

https://www.kansas.gov/bess/flow/main?execution=e2s5

Courtesy Gator11

Float> 335,849,714 FLOAT UNCHANGED SINCE JUNE 20, 2014

NO DILUTION, Toxic Debts or Hidden Rules 44 here...

Any past Toxic debt was bought up brilliantly by management well over a year ago!

Pacific Stock Transfer Company

4045 S. Spencer Street, Suite 403

Las Vegas, NV 89119

Phone: 702.361.3033

Fax: 702-433-1979

Toll Free: 800.785.PSTC (7782)

Billing Department

Pacific Stock Transfer Company

Billing Department

ATTN: Lisa Upham

173-3 Keith Street

Warrenton, VA 20186

Phone: (571) 485-9998 Fax (540) 347-3075

REAL ESTATE PURCHASE

CONTRACT

Courtesy sororitygirls

This REAL ESTATE PURCHASE CONTRACT (the “Contract”), is dated December , 2014 (the “Effective Date”), by and between Q LOTUS, INC., a Nevada corporation (the “Purchaser”) and LAKE ZURICH CENTER, LLC, an Illinois limited liability company (the “Seller”). The “Effective Date” shall be the date upon which this Contract is accepted by Seller.

https://www.lawinsider.com/contracts/2aS5ZVRg...2015-01-20

Developer has idea for old bank to revitalize downtown Lake Zurich

http://www.dailyherald.com/article/20131014/news/710149938/

From 8K 11-5-12

Item 1.01 Entry into a Material Definitive Agreement.

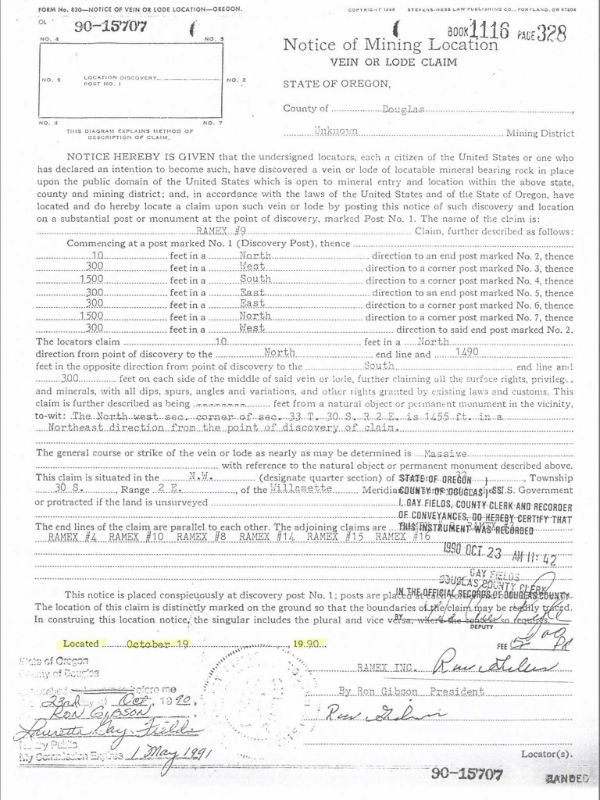

On October 15, 2012, Q Lotus Holdings, Inc. (the “Company”) entered into a Modified Purchase Rights and Completion Agreement (the “Agreement”) with Prospect Silica Enterprises, Inc. (“PSEI”) pursuant to which the Company’s unencumbered clear title to twenty (20) silica mining claims in Oregon (“claims”) was confirmed, and certain profit sharing rights of PSEI were established and documented including the right to one third of all profits generated by any and all operations resulting from the claims with a minimum of five million dollars ($5,000,000) in the aggregate. The Company and PSEI have agreed to work together toward mining and monetization of the claims as deemed appropriate. PSEI agrees to provide all historical and current assays, studies, analyses, valuations, certifications, test results, appraisals and any other pertinent data related to the claims. The full Agreement is attached hereto and incorporated herein by reference.

http://yahoo.brand.edgar-online.com/DisplayFi...53d1391142

February 23 2010

Silica Deposit in the Prospect Ranger District Quartz Mountain and Subsequent Correspondence per RAMEX claims

Courtesy wayno2

Dear Ron,

I am so glad to see you are progressing on the Quartz Mountain property. If I understand what you want from me, I will explain as follows; you want my considered opinion of the estimated value of 400 acres of the total reserves of silica claims on Quartz Mountain.

Reference is made to my letters of October 31, 2005 and February 29, 2008. Any mineral deposit value is predicated on the value and demand at the time the opinion is given. That being said, the value of the claims has doubled since I last examined them in October of 2005. The volume has not changed-nor will it.

The amount of tonnage in the 400 acre block at 100 feet depth equals approximately 175,000,000 tons today worth $80/ton or $14B. This is by no means the total of the deposit.

As you and I discussed, when standing on the lower end of your claims, we could see the exposed silica on three sides at over 500 feet in elevation. In my opinion, there is at least 5 times the amount as stated above. This is what I believe and seems to be consistent with the opinion of other geologist reports.

Ron, you know I am conservative by nature but I have never seen a deposit of this magnitude. If I can be of further assistance, please advise.

[Ed. Note: The 400 acres are comprised of claims Ramex #2, #3, #4, #5, #8, #9, #10, #11, #14, #15, #16, #17, #19, #20, #21, #22, #23, #24, #25, #26]

Sincerely,

/S/Robert L. Salmon

Robert L. Salmon

https://www.sec.gov/Archives/edgar/data/13911...h_10-5.htm

Jackson County Oregon Ramex Active Claims Owners:

Courtesy gator11

https://thediggings.com/usa/oregon/jackson-or...tab-active

https://thediggings.com/mines/ormc156974

Q Lotus Incorporated is a Corporation entity with a interest relationship based in Chicago, IL. Q Lotus Incorporated is named in 20 claims in Oregon—18 are active and 2 are closed.

https://thediggings.com/owners/2333024

Silica uses in every day life:

Courtesy wayno2

https://www.google.com/search?q=silica+uses+i...BLYQsAQIaw

Geological Reports:

Courtesy wz9ytp

http://www.oregongeology.org/sub/milo/archive...etters.pdf

Link Courtesy Sib

http://www.oregongeology.org/sub/milo/archive...eports.pdf

The general course or Strike of the Vein or Lode as nearly as may be determined is MASSIVE ... indicative of all the QLTS claims .

Q Lotus Holdings Inc. (OTCMRKTS: QLTS) Stock Message Board