4) 1911 Gold - Vision for the future .............

Post# of 286

All essential infrastructure is in place: Established underground mines and a functioning ore processing mill. The management is striving to delineate gold resources to 2 million ounces or more before reopening some or all of the mines in the Truth North Mine Complex and restarting gold production. CEO Shaun Heinrichs pledged to grow the company organically by acquiring more gold properties. He said the gold resources in the Central Manitoba projects is huge, shortly after gold production begins, Ogama-Rockland Mine and Central Manitoba Mine will join in to provide high grade ores to feed the mill. He reckons that the company can produce 80,000 ounces of gold annually with a mine life of 10 years based only on current gold resources.

At gold price of $2,600 and All-In-Sustaining-Cost per ounce of gold at around $1,400, production profit will be $1,200 per ounce, equating to annual production profit of $96 million (approximately CAN$134 million). 1911 Gold will grow organically and swiftly in the coming 2 to 2 1/2 years.

CEO Shaun Heinrichs quoted: "Looking beyond 2 1/2 years, the company will be stepping out the regional footprint into a wider operation".

Here is my theoretical forecast on cost and profit:

Equipment to get the underground mine operating: $40 million = $20 per ounce ($40 million / 2 million ounces)

Cash Cost is between $700 and $800 per ounce.

Current Average All-In-Sustaining-Cost of mid-tier gold producers: $1400 per ounce.

Production Cost = [Equipment Cost + Cost to Operate] / Total Gold ounces

= $20 + $1400 = $1420 per ounce

Gold Sales: $2600 per ounce

Future Profit (excluding administrative cost, exploration cost, maintenance cost, taxes) = $2600 - $1420 = $1180 per ounce = $2.36 Billion for 2 million ounces (CAN$3.3 Billion).

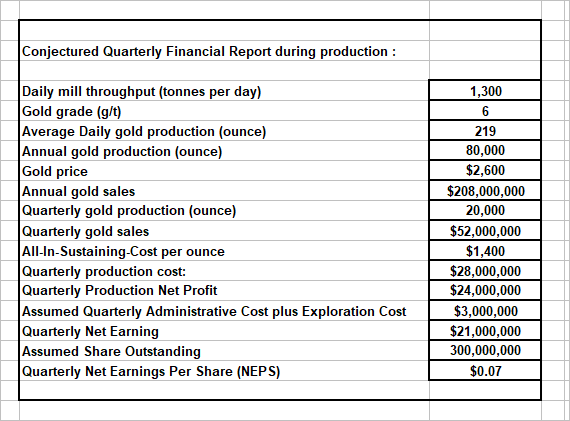

My conjectured Quarterly Financial Report during production :

https://investorshangout.com/images/MYImages/...ancial.png

Alternatively, 1911 Gold shareholders may be willing to sell the company to another gold producer earnestly seeking potential properties to replenish its dwindling reserves or for continuous growth. Certainly the company is a compelling buyout target due to its well established infrastructure and seemingly endless supplies of high-grade gold ores.

- The established 1,300 tonnes per day ore processing mill, expandable to 2,500 tonnes per day. It has a replacement value of US$300 million. There is also a mill at San Antonio mine, also a mill at the Central Manitoba mine, all of them can contribute to accelerating gold production.

- The underground gold mines with historical 2 million ounces gold production and confirmed further mineral extensions.

- The 580 square kilometers of exploration land with high grade gold resources potential based on historical and recent drilling data.

- 1.2 million ounces of gold resources and increasing.

- 1911 Gold is debt-free.

At 2 millions ounces of gold resources, the company's reasonable Enterprise Value (EV) is $200 million, but the consideration is only for the gold resource value, it does not account for value of the mill, the underground mines and the enormous prolific exploration land. The company should worth at least $400 million or $2.60 per share (CAN$3.60) at 153 million shares outstanding.

At buyout offer of $400 million, the buyer's Total Acquisition Cost (TAC) per ounce gold is as follow:

Enterprise Value (EV): $200 per ounce. ($400 million for 2 million ounces of gold).

Equipment to get the underground mine operating: $40 million = $20 per ounce ($40 million / 2 million ounces)

All-In-Sustaining-Cost (AISC): $1400 per ounce

TAC = [Cost to Acquire + Cost to Build + Cost to Operate] / Total Gold ounces

= $200 +$20 + $1400 = $1620 per ounce

Gold Sales: $2600 per ounce

Future Gross Production Profit = $2600 - $1620 = $980 per ounce = $2 Billion for 2 million ounces (CAN$2.8 Billion).

https://investorshangout.com/1911-Gold-Corp-AUMBF-94051/

(0)

(0) (0)

(0)