4) 1911 Gold - Vision for the future .............

Post# of 232

From 2011 to 2015 gold price declined from all time high of $1,900 to $1,050 ( https://mrci.com/pdf/gc.pdf )

In the same period, XAU Mining Index declined from all time high of 225 to 35 ( https://bigcharts.marketwatch.com/advchart/fr...0&size )

Declining gold price to below production cost has decimated some marginal gold producers as well as many gold explorers as investor interest in the resource sector vanished. It also culled the precursor debt-ridden company, San Gold. Subsequent recovery in gold price and hoarding by central banks worldwide amid currency crisis and geopolitical tension in the South China Sea and in Europe has sent gold price soaring. With gold price currently at $2,600 and surging towards $3,000, well above the All-In-Sustaining-Cost of $1400 for each ounce of gold produced, there is no doubt that 1911 Gold's operation will be profitable.

CEO Shaun Heinrichs pledged to grow the company organically. There is an excellent chance that the company will succeed because all the essential infrastructure is in place and the company is debt-free. The management plans to delineate gold resources to 2 million ounces or more before reopening some or all of the mines in the Truth North Mine Complex and restarting gold production. Shortly after gold production resumes, Ogama-Rockland Mine and Central Manitoba Mine will join in to accelerate gold production.

Imagine producing average 75,000 ounces of gold annually at average gold price of $2,600 with AISC at around $1,400. Production profit will be $1,200 per ounce with annual production profit of around $90 million (CAN$125 million). 1911 Gold will grow organically and swiftly in the coming 2 to 2 1/2 years. With accretive earnings and cash in the coffer, with market capitalization exceeding $100 million, 1911 Gold will be the leader among its peers! Shaun Heinrichs quoted: "Looking beyond 2 1/2 years, the company will be stepping out the regional footprint into a wider operation".

1911 Gold's Production Cost:

Equipment to get the underground mine operating: $40 million = $20 per ounce ($40 million / 2 million ounces)

Cash Cost is between $700 and $800 per ounce.

Current Average All-In-Sustaining-Cost of mid-tier gold producers: $1400 per ounce.

Production Cost = [Equipment Cost + Cost to Operate] / Total Gold ounces

= $20 + $1400 = $1420 per ounce

Gold Sales: $2600 per ounce

Future Gross Production Profit (excluding administrative cost, exploration cost, maintenance cost) = $2600 - $1420 = $1180 per ounce = $2.36 Billion for 2 million ounces (CAN$3 Billion).

Fact sheet:

Daily ores throughput: Minimum 1,300 tonnes per day, expandable to 2,500 tonnes per day, average 1,900 tonnes per day.

Daily gold production: Average 1,900 tonnes per day at gold grade of 6 grams / tonne = 407 ounces per day

Annual operating days: 250 days (closed on holidays and weekends to mitigate miner fatigue and down times)

Annual gold production: 407 ounces per day x 250 days = 101,750 ounces

Annual gold sales: 101,750 ounces x $2,600 per ounce = $264 million

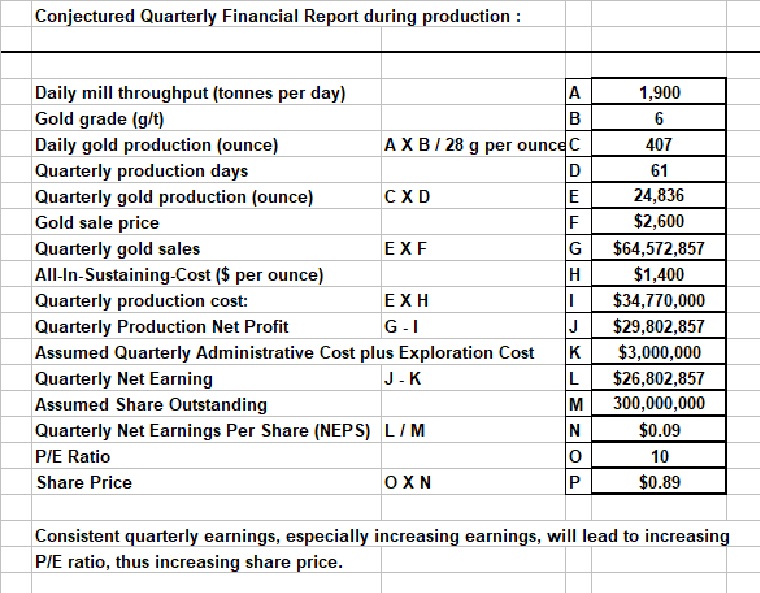

Here is a conjectured Quarterly Financial Report during production :

https://investorshangout.com/images/MYImages/...ancial.jpg

Alternatively, 1911 Gold shareholders may be willing to sell the company to a senior gold producer which is desperately seeking potential properties to replenish its dwindling reserves. It will be approved in a special meeting if shareholders are content with the high buyout price. Certainly the company is a compelling buyout target due to this well equipped infrastructure:

- The established 1,300 tonnes per day ore processing mill, expandable to 2,500 tonnes per day. It has a replacement value of US$300 million. There is also a mill at San Antonio mine, also a mill at the Central Manitoba mine, all of them can contribute to accelerating gold production.

- The underground gold mines with historical 2 million ounces gold production and confirmed further mineral extensions.

- The 580 square kilometers of exploration land with high grade gold resources potential based on historical and recent drilling data.

- 1 million ounces of gold reserves / resources and increasing.

- 1911 Gold is debt-free.

At 2 millions ounces of gold resources, the company's reasonable Enterprise Value (EV) is $200 million, but the consideration is only for the gold resource value, it does not account for value of the mill, the underground mines and the enormous prolific exploration land. The company should worth as much as $400 million or $2.60 per share (CAN$3.30) at 151 million shares outstanding.

The buyer's Total Acquisition Cost (TAC) per ounce gold :

TAC = [Cost to Acquire + Cost to Build + Cost to Operate] / Total Gold ounces

Enterprise Value (EV): $100 per ounce. ($200 million for 2 million ounces of gold).

Equipment to get the underground mine operating: $40 million = $20 per ounce ($40 million / 2 million ounces)

All-In-Sustaining-Cost (AISC): $1400 per ounce

TAC = $100 +$20 + $1400 = $1520 per ounce

Gold Sales: $2600 per ounce

Future Gross Production Profit = $2600 - $1520 = $1080 per ounce = $2.16 Billion for 2 million ounces (CAN$2.8 Billion).

(0)

(0) (0)

(0)